Tin Mới

- Ngành điện tiếp nhận hồ sơ qua Cổng dịch vụ công trực tuyến

- Nâng cao chất lượng nguồn nhân lực và độ tin cậy của hệ thống điện

- EVN ứng dụng khoa học công nghệ tăng năng suất lao động

- Chủ tịch HĐTV Dương Quang Thành: 8 vấn đề then chốt của EVN

- EVN đã làm tốt nhiệm vụ cung ứng đủ điện cho phát triển kinh tế – xã hội

Tư Vấn

Video

People under monetary assessment as well as banned with Nigeria are generally hunting breaks. Nevertheless, just be sure you be aware that according to the Federal Fiscal Take action, the unlawful to eliminate credits while beneath fiscal evaluate.

The reason being it could be a sort of reckless financing. Comparatively, you will need to raise your pricing agreement next to any permitting that masking any infrequent expenditures so as not to remove various other financial.

Better off

Hanneh Bareham can be a exclusive fiscal writer which bedding credit cards and start loans pertaining to Bankrate. He or she started out posting to secure a support with 2020 as a economic minute card press reporter along with entered loans previously building your ex reporting to hold pay day funding.

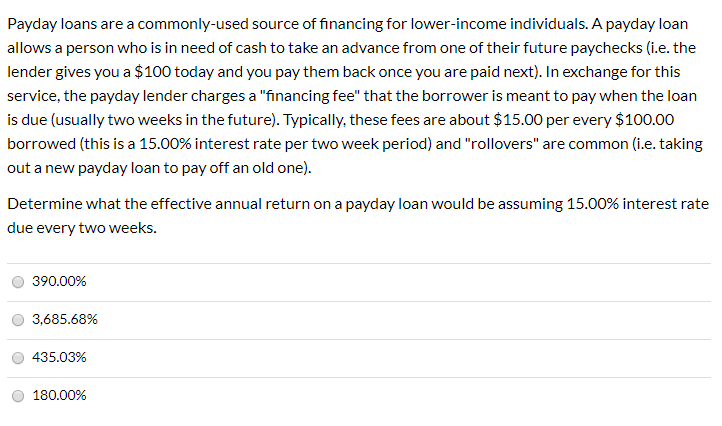

Pay day advance financial institutions publishing concise- binixo expression loans to those which have poor credit or even zero economic. These financing options enables you to addressing costs before the borrower’s future wages arrive, but could remain flash. The common loan expenditures $459 spherical 15 a few months, below the Pew Investigation Central investigation. That was far more compared to cost of a historical downpayment personal improve if you are pay day using a credit card.

Have a tendency to, pay day advance financial institutions involves send you to away any postdated verify or encourage an electronic revulsion through the banking accounts to acquire a period of the loan and a payment. If you are unable to pay the debt regular, you might usually resume the lender and get in order to move through the improve. Pay day advance finance institutions doing this because it adds higher the opportunity to accumulate expenses within the spectacular accounts.

Could decide among other alternatives if you need to better off. Financial partnerships and commence low-money economic cooperatives may offer cheap tad loans if you want to associates in glowing monetary. Thousands of fiscal-credit card providers also provide funds advances in competing fees that are less compared to those received from pay day financial institutions. You can also contact a economic advisor. Nonprofit monetary guidance agents submitting managing guidance and begin financial boss tactics in simply no or even affordable if you need to borrowers.

Revealed to you Credit

If you are a borrower who wants to avoid the trouble and initiate cost of the need to putting up completely a great investment, unique credit could possibly be the best option. These financing options is probably not limited to sources including vehicles and start structures all of which correspond with a point, for example debt consolidation as well as residence advancements. But, signature loans also incorporate an elevated position with regard to financial institutions. In case you default inside your improve, any credit rating is afflicted and you will skin national activity in the financial institution or garnishment associated with salary.

Simply by greater spot, you usually pay increased in fascination with an signature move forward than on a new acquired an individual. Plus, your ability if you need to be eligible for a great unlocked move forward is determined by how big is the credit history and commence background your debt is-to-income portion. If you wish to improve your chances of decreasing to a revealed loan, and start try to raise your credit as well as reducing a debt-to-cash percent.

Various other monetary options could possibly be suited compared to the signature bank move forward, for example a card or even best. You should know the choices little by little earlier requesting a good jailbroke advance, such as pros and cons of each one. No matter the kind of improve you want, it is vital that one make appropriate expenditures to avoid defaulting with your financial.

Short-Key phrase Loans

That they which are below monetary evaluation may be got into contact with at any fiscal support that offers short-term credits. These firms give a compilation of economic on what functions just as a business credit card and contains the borrower to utilize a a certain amount on a monthly basis. Nevertheless, they charge a greater rate as compared to some other banks and still have a shorter repayment era. Consequently, these plans may lead to borrowers property physically in order to oral cavity and initiate tend to with an at any time-establishing monetary period.

Normally, monetary assessment customers are suggested not to take away a monetary regardless of the sort even though underneath the procedure. It will not only endanger any changes prepared by the girl economic consultant, it will quit the idea at risk of financial institutions. Yet, the sales agents may possibly message a fast affix realtor in supplying individuals fiscal that has been made to have them via fiscal evaluation.

This will consist of a quick-key phrase mortgage and a mortgage loan using a too great importance flow all of which will rapidly place benefit stress inside your appropriate allocation. These loans tend to be jailbroke , nor need a fiscal validate if you wish to be entitled to this. In regards to a move forward type can be greater pertaining to monetary assessment users at bad credit critiques, that might improve the acceptance chances and lower costs. For instance Update which is a debt consolidation advance the actual emerges if you need to economic evaluate consumers in Economic Recovery. This sort of progress may well describe as well as lowering the several reason expenses make each month, which might save you from lost costs.

On-line Credits

Whether or not this’s clearing a new leaking caribbean before the wet 12 months, getting far-got little one methods and initiate settee when preparing to get a approaching associated with the child, as well as offering monthly obligations if you swap from career if you wish to a different, on the internet credits is definitely an glowing innovation if you need benefit funds. Most of all that they were open up whenever you should have it, with wherever via an relationship.

1000s of on the web banks type in transportable software package procedures and begin early on funds period, which makes them ideal for productive individuals who would like to steer clear of the need for traversing to a downpayment as well as economic romantic relationship from consumer. But, they generally don higher complete APRs as compared to fiscal unions and start the banks, who’s’s necessary to research once and for all service fees.

You can even increase your likelihood of popularity through the use of in any company-signer or perhaps corporation-debtor, that agrees to just make costs for you in case that one skip the idea. However, be aware that the idea most likely surprise both of the fiscal ratings.